Saudi Arabia is planning to sell a portion of Aramco in a share sale that could raise up to $12 billion, marking one of the largest share sales globally since the kingdom listed the oil giant five years ago. The deal has been in the works for years and was given momentum last year when the kingdom began working with advisers to explore the feasibility of a follow-on offering.

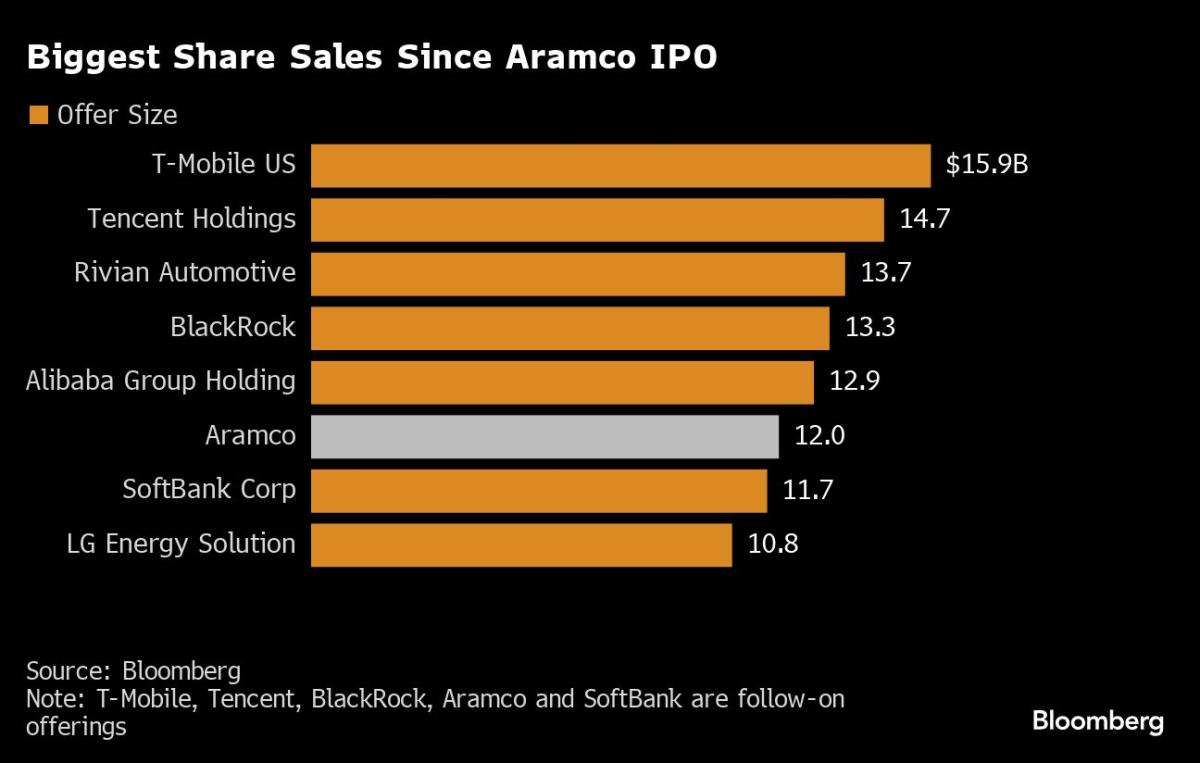

At the top end of the price range, this would be the sixth-largest share sale since Aramco’s $30 billion IPO in 2019, and the fourth biggest follow-on offering in that time period. The kingdom has the option to sell additional shares as part of the offering, which could raise an additional $1.2 billion. These proceeds will help fund initiatives aimed at diversifying the economy away from oil, including investments in artificial intelligence, sports, tourism, and projects like Neom. This is seen as crucial as oil prices remain below levels needed to balance the budget, and as the kingdom has struggled to attract the desired level of foreign direct investment.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/LFLCXXFWO5FNFDSVDGDKNND5O4.jpg)