Consumers are increasingly able to make and control recurring payments through their mobile phones, as banks and billers look to automate the process for them. Now, this functionality is being offered directly to consumers through their banking apps.

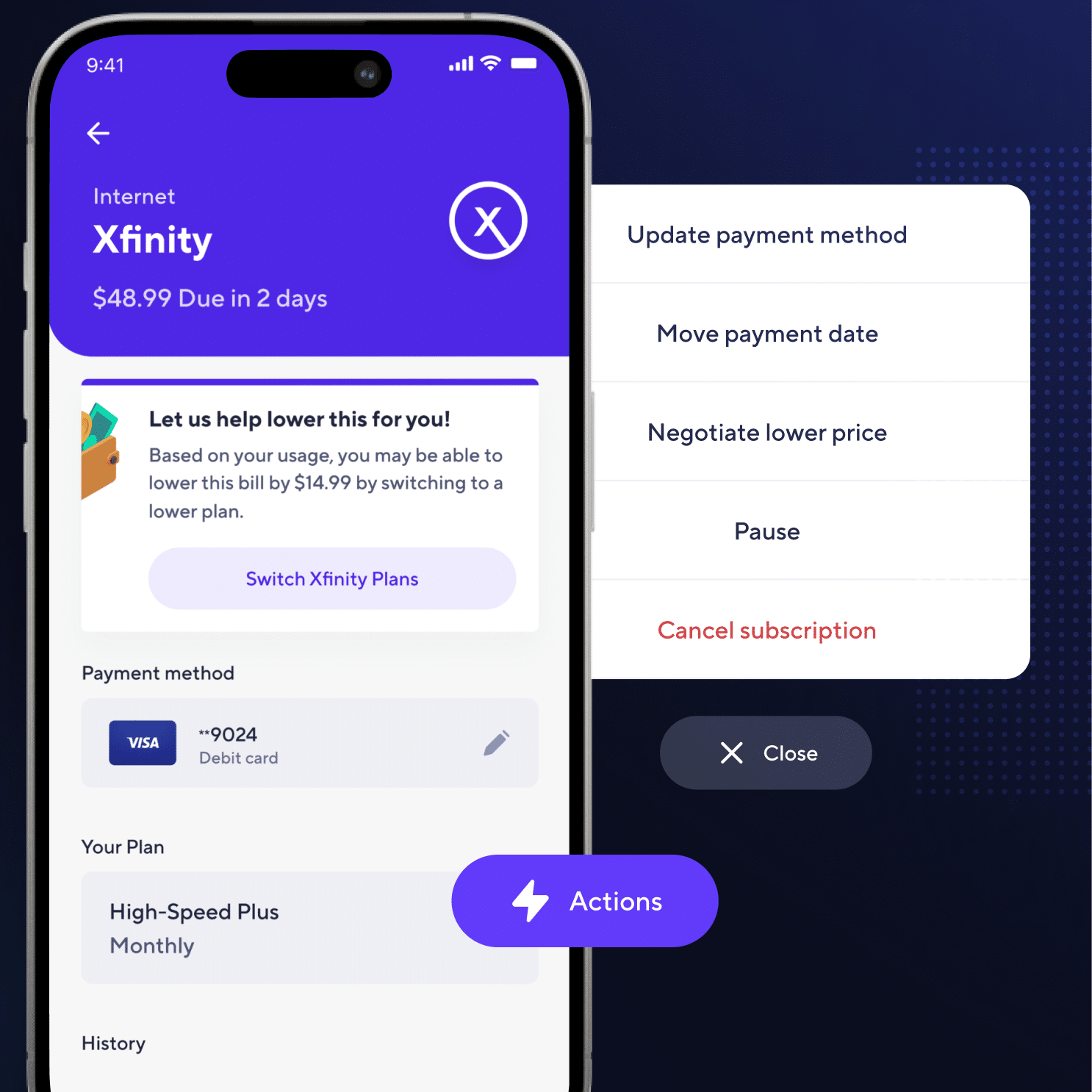

One example of this is Atomic Financial, a Salt Lake City-based company that has developed an app called PayLink Manage. This app allows users to view and pay bills within their banking app, with options for rescheduling payments, issuing payments on specific dates, and canceling subscriptions. Frost Bank in Texas was one of the first financial institutions to adopt this technology from Atomic Financial.

Atomic Financial’s PayLink Manage app provides consumers with real-time options for recurring bills without requiring a separate app. Users can make immediate payments, reschedule payments, cancel payments, and set up payments for specific dates. The app is free for users and comes at a time when the subscription market is expected to grow to $1.5 trillion by next year, according to Digital Route’s data tracking company.

Atomic cofounder and CEO Jordan Wright believes that subscription management will become a necessary feature in all leading consumer banking applications in the coming years. By informing cross-sell efforts based on customers’ spending habits, financial institutions can gain valuable insights into consumer behavior and preferences, allowing them to better tailor their products and services to meet customer needs.