Revolut has recently expanded its investment offerings in Croatia by adding bonds and providing investment services through Revolut Securities Europe UAB. This move comes after a survey conducted by Dynata on behalf of Revolut, which revealed that 37% of Croats have low risk tolerance and are seeking safer investment options. Among the 15 European countries surveyed, Croatian citizens were found to be the most conservative investors, with an average of 29% preferring safer investment options.

Bonds are an ideal option for investors with low risk tolerance as they offer stability and diversification potential. They typically come with good credit ratings and protection against inflation, making them attractive to investors seeking reliable returns. Bonds are utilized by both governments and corporations to raise capital, allowing investors to lend money in exchange for regular interest payments and the return of their invested funds at the end.

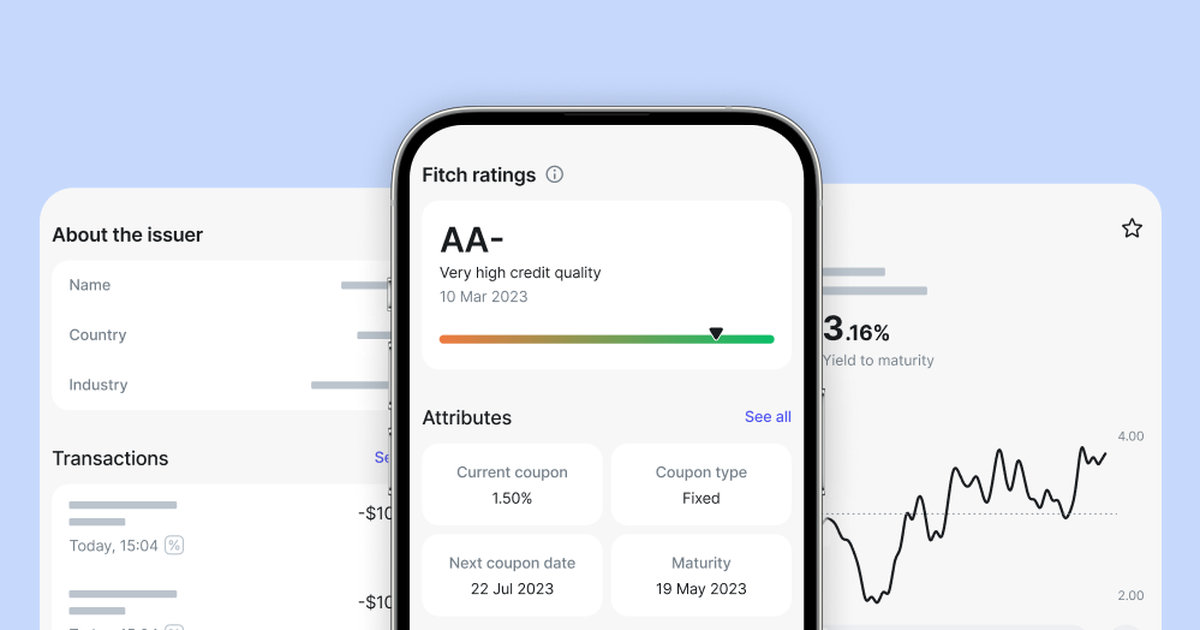

Revolut’s current investment offering includes nearly 40 corporate and government bonds, with plans to expand this list in the future. The minimum investment amount for bonds is $100 USD/EUR, with a fixed fee of 0.25% per trade (minimum fee of $1 USD/EUR). Revolut aims to create a comprehensive investment platform that caters to a wide range of investors within the EEA. Users can access over 2,800 US and European stocks, more than 500 exchange-traded funds (ETFs), and real-time performance tracking tools within the Revolut app.

It is important for users to note that all investments carry a risk of capital loss, including bonds. The value of investments can fluctuate, past performance may not indicate future performance, there is a risk of default by the bond issuer which could result in losing the entire investment, currency fluctuations may also impact the value of investments. Before making any investment decisions, users should review Revolut’s Trading Terms and Conditions, FAQ on Fees, and Risk Disclosure carefully.

In summary, Revolut’s addition of bonds to its investment offering in Croatia allows it to cater to more conservative investors who seek safer options while maintaining its comprehensive platform that caters to a wide range of users within the EEA.