Priority Technology Holdings Inc (NASDAQ:PRTH) is a company that offers merchant acquiring and commercial payment solutions. The company has a platform for merchants, banks, and distribution partners to enhance their businesses through payment processing services. Recently, Chief Strategy Officer Sean Kiewiet sold 59,727 shares of the company on May 24th. This transaction was disclosed to the SEC on the same day, leaving Kiewiet with 1,241,853 shares. Over the past year, Kiewiet has sold a total of 263,951 shares without making any purchases. The insider transaction history for Priority Technology Holdings Inc shows a trend with 1 buy and 22 sells over the past year.

On May 24th, shares of Priority Technology Holdings Inc were trading at $3.83, giving the company a market capitalization of $357.091 million. According to GF Value, the stock is considered modestly undervalued with a price-to-GF-Value ratio of 0.68 based on a GF Value of $5.67. The GF Value is calculated by considering historical multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow while also including adjustments based on past financial performance and future business estimates from analysts.

Keep in mind that this article is not personalized financial advice and should not be used as investment recommendations or financial planning tools. It is based on historical data and analyst projections using an impartial methodology that may not account for recent qualitative information or company announcements that may affect stock prices negatively or positively. Additionally, GuruFocus does not own any positions in the stocks mentioned in this article.

In conclusion, Priority Technology Holdings Inc appears to be offering valuable services to its customers while also presenting opportunities for investors looking to diversify their portfolios with undervalued stocks in the merchant acquiring industry. However, investors should carefully consider their investment objectives and financial situations before making any decisions regarding investing in this or any other stock market asset class.

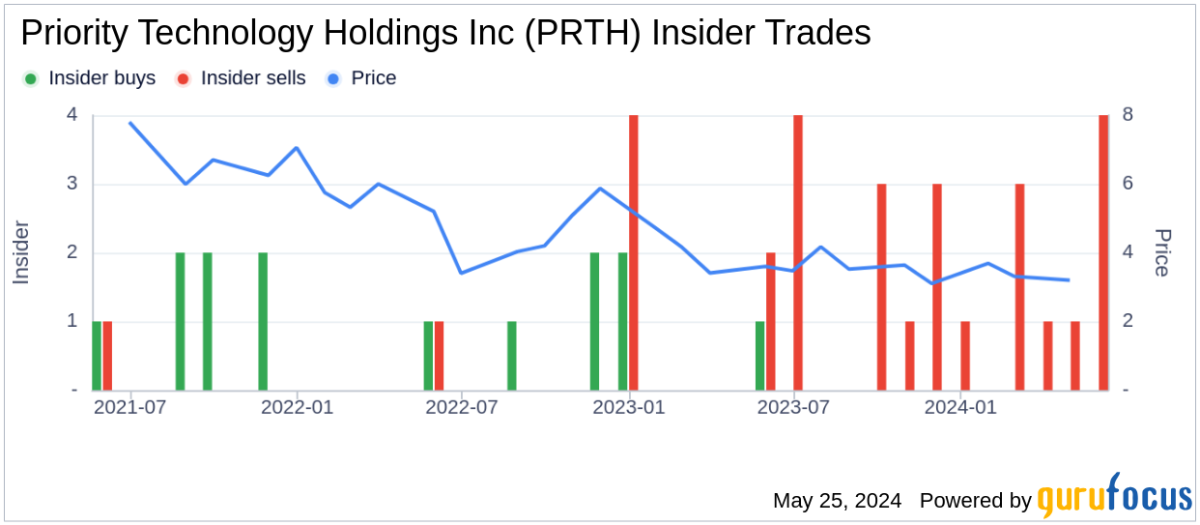

Insider Transactions:

Over the past year:

Buy: 1

Sells: 22