Since 2019, the federal public sector’s debt has increased by 5.2 percentage points of GDP, reaching 15.44 trillion pesos in the first quarter of this year. This is lower than the previous administration of former President Enrique Peña Nieto and 670 billion pesos lower compared to the administration of Felipe Calderón when adjusted for inflation. Despite a rise in internal reference interest rates, where most of the public sector debt is contracted, from 8 to 11.25 percent, there has been a slowdown in public debt accumulation over the past five years. The federal government has not received operational surpluses from the central bank due to the appreciation of the national currency, unlike previous governments that used these profits to reduce debt.

The public sector debt in March of this year stood at 15.44 trillion pesos, inclusive of the federal government’s, development banks’, Pemex’s, and CFE’s liabilities. In nominal terms, this represents a 42.4 percent increase from March 2019, reaching 45.2 percent of GDP, slightly higher than the 43.6 percent recorded in March 2019. The head of the Ministry of Finance, Rogelio Ramírez de la O, stated that the public debt has remained stable in recent years and is at a sustainable level in the medium term. The current administration has focused on restructuring the debt to rely more on internal financing, reducing exposure to foreign currency fluctuations and interest rates.

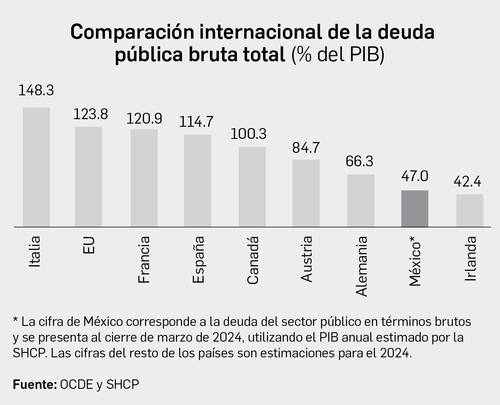

Despite the increase in debt and deficit, Mexico considers its current debt level of around 50 percent GDP to be sustainable