Intel has recently disclosed revenue totals for its foundry business for the first time. Traditionally, Intel has been responsible for both designing its own chips and manufacturing them, reporting final chip sales to investors. In contrast, other American semiconductor companies like Nvidia and AMD design their chips but outsource manufacturing to Asian foundries, typically Taiwan’s TSMC.

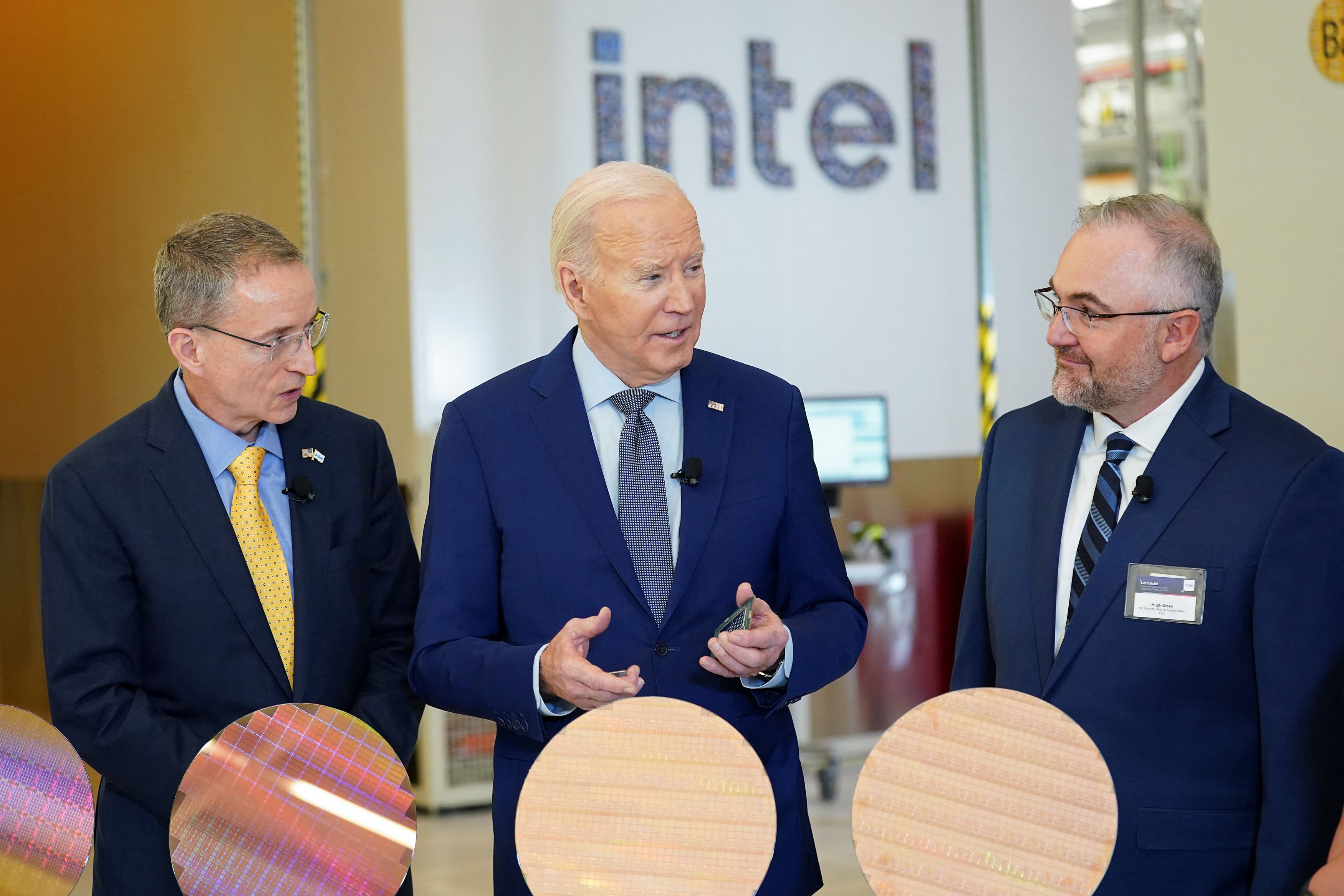

Under CEO Patrick Gelsinger, Intel has been presenting a plan to investors that involves continuing to make its own processors while also starting an external foundry business to produce chips for other companies. The fact that Intel is one of the few U.S. companies engaged in cutting-edge semiconductor manufacturing on American soil played a significant role in the company securing nearly $20 billion in CHIPS and Science Act funding recently.

On Tuesday, Intel revealed that much of its foundry revenue currently comes from its own operations. The chipmaker has also restructured its Products division to account for its costs as though it were a “fabless” company that considers foundry as an expense. The newly organized Products division, which predominantly includes processors for PCs and servers, reported $11.3 billion in operating income on $47.7 billion in sales in 2023.

Additionally, Intel stated that it anticipates its foundry’s losses to reach their peak in 2024 and eventually break even “midway” between the current quarter and the end of 2030. The company has previously announced that Microsoft will use its foundry services and has already secured $15 billion in revenue for foundry services.

During an investor call on Tuesday, Gelsinger mentioned that Intel Foundry would contribute significantly to Intel’s earnings growth over time, with 2024 expected to be the year with the lowest foundry operating losses. Intel attributed the lack of profitability in its foundry business to past decisions and Gelsinger specifically pointed out the company’s slow adoption of EUV technology, crucial for producing advanced chips.