Priority Technology Holdings Inc (NASDAQ:PRTH) has recently experienced a significant shift in its stock ownership. On May 24, 2024, the company’s Chief Strategy Officer, Sean Kiewiet, sold a large number of shares to the public. The SEC reported the transaction on the same day. Following this sale, Kiewiet now owns a sizeable portion of the company’s stock.

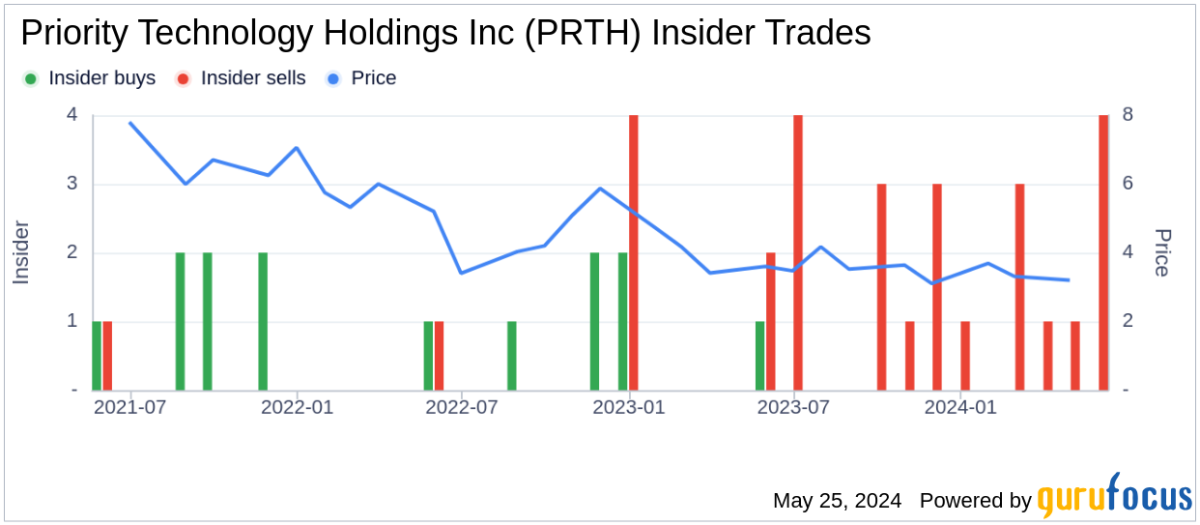

Priority Technology Holdings Inc is an established provider of merchant acquiring and commercial payment solutions. The company operates a platform that enables merchants, banks, and distribution partners to enhance their businesses through payment processing. Over the past year, Kiewiet has sold 263,951 shares of the company’s stock without making any purchases. This trend is consistent with other insider transactions within Priority Technology Holdings Inc over the last year, which have seen 1 insider buying and 22 insiders selling shares.

At the time of the most recent transaction, shares of Priority Technology Holdings Inc were trading at $3.83. With a market capitalization of $357.091 million, it appears that the stock may be undervalued based on its price-to-GF-Value ratio of 0.68 (based on a GF Value of $5.67). However, it’s important to note that this analysis is grounded in historical data and analyst projections and does not constitute specific investment guidance or take into account recent company announcements or qualitative information.

GuruFocus provides this information for informational purposes only and does not hold any position in Priority Technology Holdings Inc or any other stocks discussed in this article.

Overall, Kiewiet’s significant sale of shares raises questions about his confidence in Priority Technology Holding’s future growth prospects or whether he believes it is overvalued at its current market price.

It’s worth noting that while insider transactions can provide valuable insights into a company’s management team’s beliefs about its future prospects or potential risks to investors, they should not be taken as definitive evidence either way.

In conclusion, while Kiewiet’s sale of shares may signal some level of uncertainty about Priority Technology Holding’s future prospects or potential risks to investors; investors should also consider other factors such as financial reports from management team and external experts before making investment decisions related to this company or any other stocks discussed in this article.