The recent surge in AI-related stocks has pushed American stock market prices to new heights, but investment strategist Paul Jackson warns of a potential correction. He believes that US stocks are overvalued and the AI sector is a bubble that is likely to burst.

Investors are cautioned against taking on unnecessary risks as historically, highly valued markets tend to lead to modest or negative returns in the long term. While other stock markets around the world, particularly in Europe, are currently more attractively valued.

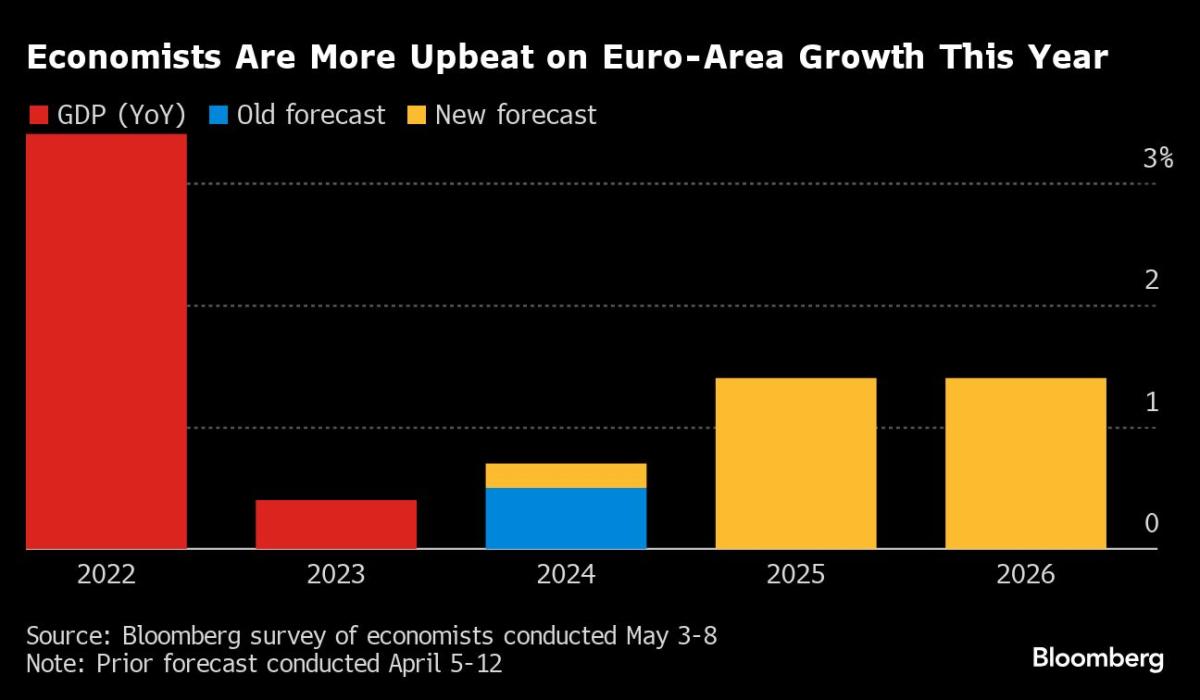

The current economic landscape shows a surprising shift where Europe is outperforming the US economy. Despite falling real disposable income in the US and losing momentum, Europe is emerging as a potential winner. While the US economy appears dynamic, a closer look reveals that Europe is actually ahead on a per capita basis.

Investing in US stocks has become a cause for concern due to the country’s high national debt burden and escalating debt servicing costs. The prospect of a second Donald Trump presidency adds uncertainty, especially with regards to his potential influence on the Federal Reserve.

To position themselves prudently for potential market shifts, investors are advised to consider diversifying their portfolios away from US stocks and high-yield bonds. Instead, a focus on European markets, China, emerging markets, commodities, and real estate investments may offer more attractive opportunities. By reevaluating investment strategies and focusing on fair value rather than blindly following market norms, investors can make informed decisions about their investments.