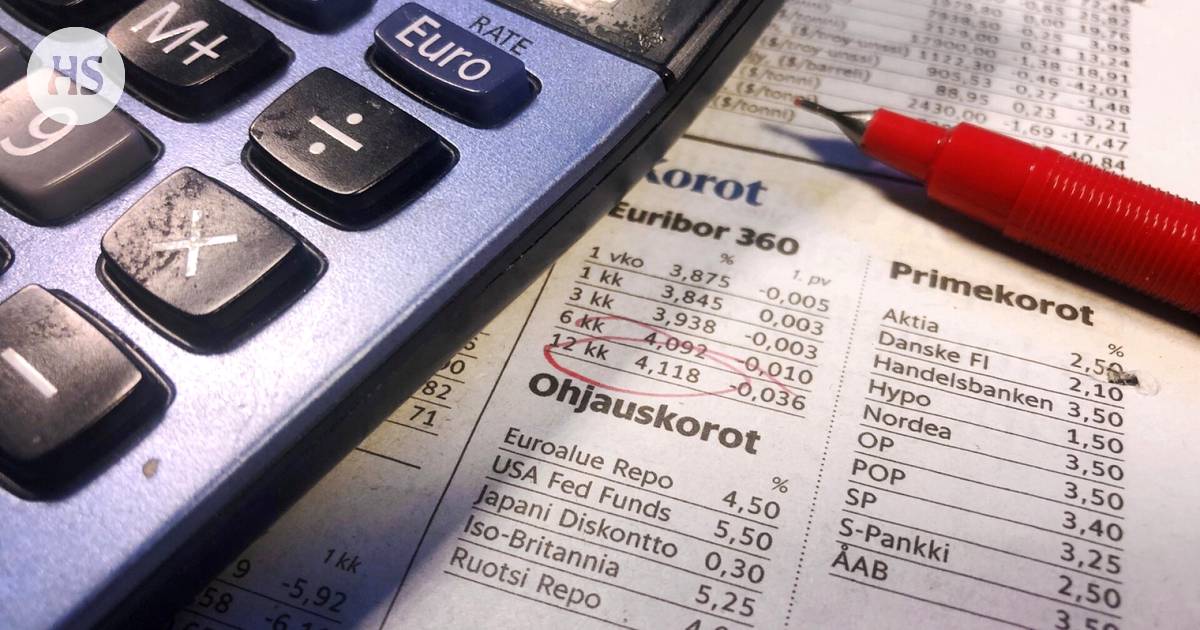

On Friday, the twelve-month Euribor rate reached its highest level in almost a month, with one-year Euribor being quoted at 3.729%, up from 3.702% on Thursday. This was the highest level seen since the end of April and indicates changes in the European Central Bank’s (ECB) policy rates. The ECB is expected to start lowering interest rates at its meeting on June 6, with further rate cuts uncertain.

Danske Bank announced on Friday that it has revised its forecast for the number of interest rate cuts by the ECB in 2019. The bank now expects two rate cuts this year – in June and December – resulting in a deposit rate of 3.5% by the end of the year. Previously, predictions suggested three rate cuts for 2019. Interest rate derivatives indicate that the central bank could lower rates by around 0.60 percentage points this year, while Nordea predicts three 0.25 percentage point decreases in the central bank interest rate in 2019.

In addition to financial news, various online profiles and blogs related to gambling and online betting platforms such as Olxtoto and Rajabandot were also mentioned in the content. There was a mix of network and community profiles as well as references to sites offering information on online slot games and casino betting. Profiles related to banking, technology, and entertainment were also included in the list of links provided in the original content.

Overall, Friday’s news signaled uncertainty about future interest rate cuts by European central banks due to changing economic conditions, which may impact borrowing costs for individuals and businesses alike across Europe.