Copper prices reached their highest level in over a week as investors weighed positive factory data from China and the possibility of output cuts by the country’s leading smelters. The official manufacturing purchasing managers index in China for March showed the highest reading in a year, indicating optimism about the world’s second-largest economy. This data, along with strong exports and rising consumer prices, has boosted market sentiment.

In the US, a factory gauge unexpectedly stopped 16 months of decline, further supporting the belief in a recovery in the manufacturing industry. This positive economic outlook is driving the consumption of raw materials like copper, despite concerns about supply constraints. However, this news also raised speculation that the Federal Reserve may delay cutting interest rates, which could have implications for commodities.

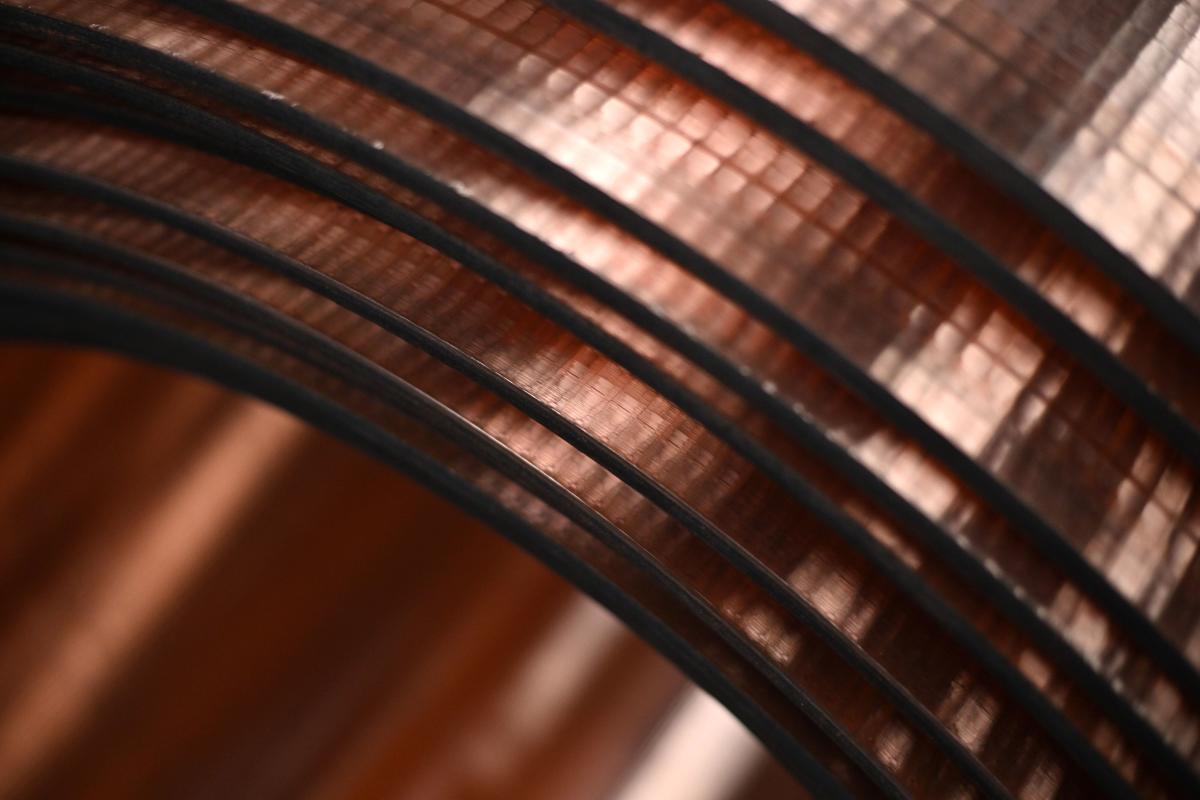

Bond traders adjusted their expectations for Fed easing this year, with the odds of a rate cut in June briefly falling below 50%. Copper prices on the London Metal Exchange rose 1% to $8,956 a ton, while nickel increased by 0.8% to $16,875 a ton and aluminum remained close to its highest level in three months. Despite these gains, there are still concerns about supply constraints due to China’s smelters considering output cuts after processing fees dropped to nearly zero.