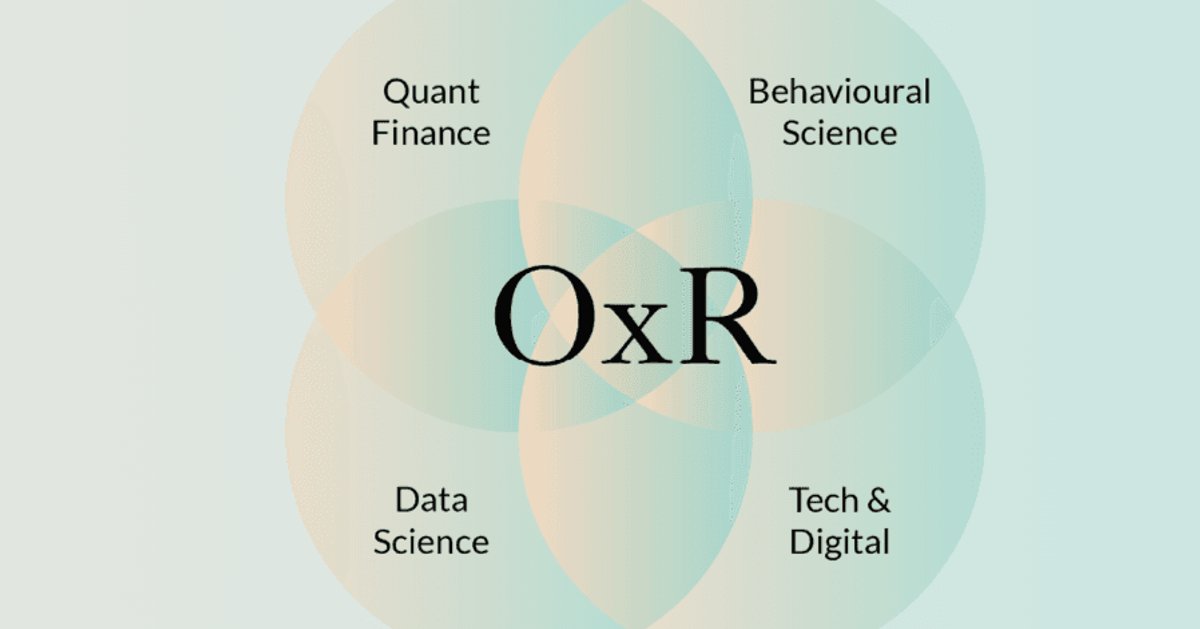

In the world of financial services, Greg Davies, Head of Behavioural Science at Oxford Risk, believes that the key to success lies in effectively engaging with clients and helping them achieve better outcomes. Davies suggests that by combining behavioral finance, data science, and AI technology, a powerful solution can be created for personalized and scalable financial decision-making. This is where Behavioral Engagement Technology comes into play.

Davies explains that Behavioral Engagement Technology helps individuals make better financial choices by mitigating the impacts of human behavior such as investment inaction. He provides an example of how this technology can aid investors in developing a moderate risk tolerance and diversified portfolio, resulting in excess returns compared to cash investments. This demonstrates the potential long-term benefits of utilizing technology to guide investment decisions and avoid missed opportunities for growth.

Davies argues that poor investment decisions often stem from lack of engagement. Therefore, improving investor engagement is crucial. However, simply increasing engagement levels without a personalized approach may not yield the desired results. This is where Behavioral Engagement Technology can be beneficial as it offers tailored insights and tools to help investors find the optimal level of engagement that works best for them.

By leveraging Behavioral Engagement Technology, investors can gain access to personalized tools and recommendations that align with their individual needs and preferences. Oxford Risk’s platform aims to provide hyper-personalized solutions that enhance the effectiveness of investment engagement on an individual level. This tailored approach can help investors navigate the complex world of finance more confidently and make informed decisions that lead to better outcomes.

In conclusion, Greg Davies believes that effective engagement with clients is crucial for success in financial services. By combining behavioral finance, data science, and AI technology with Behavioral Engagement Technology, he suggests a powerful solution for personalized and scalable financial decision-making. This technology has the potential to help individuals make better financial choices while mitigating the impact of human behavior such as investment inaction.